Nov 13, 2019 | ageist, aging, aging investor, declining health, diminished cognition, elder investor, elderly, finances for elders, financial advisors, financial capacity, financial judgement, handling money for aging parents, handling money for seniors, investor, retirement, senior investor, seniors finances

At its Senior Protection Conference on November 12, 2019, FINRA took a cell phone poll of broker-dealers. They wanted to find out how many were worried about aging registered representatives at their firms. The result: 65% were worried, according to the report published in Financial Advisor. Yes, aging B-Ds are a problem.

Here at AgingInvestor.com, we’ve been sounding the alarm about this problem since 2016, when we published our book, Succeed With Senior Clients: A Financial Advisor’s Guide to Best Practices. “The Elephant in the Room” chapter dives into how impairment in advisors affects the industry and how that most definitely will affect their work with clients. A B-D or advisor whose memory and judgment are impaired, even in the early stages, can expose the firm to liability for mistakes these folks make. Cognitive decline should not be taken lightly.

The speakers at the conference offered attendees very little concrete advice on how to address the problem of an impaired advisor. What could one expect of them? They have no training nor skill set in identifying diminished capacity themselves. Without expertise, their discussions lack action plans.

As aging experts ourselves (RN, Elder law attorney and geriatric psychologist) and a resource to the industry, we question the suggestion that one should wait for “performance issues” to surface before any firm does anything about an impaired professional in its midst. If there is a “performance issue” visible to management, it is likely that it existed for some time and harm to clients already could have occurred. The notion is reactive, not proactive. Isn’t that contrary to the essential philosophy of financial planning itself to look ahead, strategize and don’t wait for a crisis??

Waiting for a manager to call a special team assigned to address the problem is not the best approach, as we see it. For one thing, most firms don’t have a special team that would serve the purpose of knowing what to do with an impaired advisor. Yes, every firm would be well protected if such a team were formed and that is something we always recommend. However, failing to screen advisors with any in-house tools when impairment is suspected is to ignore the lurking possibility of harm to clients. What do we mean by an in-house tool? Start with a checklist.

On our website is a free downloadable Financial Advisor’s Checklist: 10 Red Flags of Diminished Capacity to help you spot the warning signs in clients. There is no reason any firm could not use relevant parts of the same tool to spot signs of diminished capacity in its own employees. It is not across-the-board applicable to the professional as compared with a client showing red flags but some points do apply to anyone. For example, memory loss, failure to appreciate the consequences of decisions, confusion, loss of ability to process basic concepts are all on the checklist and are universal warning signs.

What Can You Do With An Advisor You Think Is Impaired?

Proactive steps are essential. Here are our recommendations:

- First, record your observations of changes in the advisor’s behavior. For example, forgetting appointments, failure to meet on schedule with clients, seeing too many blank stares in your interactions with him or her, becoming withdrawn from interactions can all be signs of trouble a manager must address. They could be associated with cognitive impairment or with other health conditions. Managers need to ask the advisor about what they and other colleagues see that looks like a possible red flag.

- Ask about general health issues, which can directly impact how an advisor does the job of handling clients. Is it nosy? Yes. Is client financial safety at stake if you don’t ask? Yes. Take the risk of opening the conversation. That is smart. Waiting for a disaster is not.

- Establish an in-house policy for what should be recorded by colleagues and reported to managers about possible signs of cognitive decline and the direction you want to take after signs are identified. The policy should be in writing and distributed.

- Have a plan to closely watch the apparently impaired advisor.

Asking the advisor to work with someone to supervise transactions is one option. Reviewing how the advisor is managing his or her work at short intervals is another option. And with obviously impaired folks who do not themselves recognize their own cognitive changes (not an uncommon thing), have a suspension or graceful exit means to stop the impaired person from putting clients at risk. This falls under what those conference speakers vaguely referred to as “other arrangements”. Be specific.

This is uncomfortable territory for managers, compliance officers and for colleagues of older advisors in firms. However, the FINRA poll is telling. If this problem were not rising in our midst, 65% of those polled would not be worried. If you are concerned where you work, get your copy of Succeed With Senior Clients: A Financial Advisor’s Guide to Best Practices, now or get a live or online presentation from us at AgingInvestor.com. Don’t put your firm and your clients at unnecessary risk.

By Carolyn Rosenblatt, RN, Elder law attorney, Consultant, AgingInvestor.com

Sep 5, 2019 | aging, aging investor, cost of aging, declining health, diminished cognition, elder investor, elderly, finances for elders, financial advisors, financial capacity, financial elder abuse, financial judgement, handling money for seniors, investor

Attempts to scam money from seniors never stop. And the thieves keep getting better at thinking up ways to extract information from older folks. Here’s another one—a different phony Medicare trick.

People hear ads on TV about genetic testing and how it can predict disease and protect them. They also hear ads that they’re not getting all the Medicare benefits they deserve. Who doesn’t want to get all the benefits they should get? It’s a perfect moment for scammers.

They may call your retirement-aged client and tell them that new genetic testing is available that Medicare will pay for, worth thousands of dollars. Of course, all your client has to do is to give them their Social Security number and the free testing kit, signup papers, or other inducement will be mailed to them immediately.

Let’s be clear: Medicare does not pay for genetic testing as a “new benefit”. If for any reason such testing were needed, a physician would order it and explain why it was needed. Such testing would not be ordered without any discussion with one’s MD.

Your client should never, ever give out a Social Security number or other personal information such as date of birth or address over the phone. Your client must never accept a genetic testing kit not ordered by one’s own doctor. If it is accepted and the cheek swab, DNA test or anything else is given to the sender, your client may be billed directly, potentially incurring a debt for thousands of dollars. It would be a sad day for your client to mail in a claim for reimbursement to Medicare for a fake benefit and realize that the claim is denied. They’re on the hook for the full price.

These kinds of scams are used to get information to commit identity theft and Medicare fraud. No matter how smart your client is, anyone can be caught off guard and tricked.

What Advisors Can Do

Here are some ways to let your client know you care about their financial safety.

- Prepare a friendly form letter to send to all clients over age 65 and inform them about this scam. Warn them not to fall for it.

- Keep abreast of all the latest scams in over 30 categories at the Federal Trade Commission, which explains what they are and how they work. Keep clients advised.

If identity theft has happened, direct your client to the Federal Trade Commission website for instruction on what to do.

Carolyn Rosenblatt, RN, Elder law attorney, AgingInvestor.com

About Carolyn Rosenblatt and Dr. Mikol Davis

Carolyn Rosenblatt and Dr. Mikol Davis are co-authors of The Family Guide to Aging Parents (www.agingparents.com) and Succeed With Senior Clients: A Financial Advisors Guide To Best Practices. Rosenblatt, a registered nurse and elder law attorney, has more than 45 years combined experience in her professions. She has been quoted in the New York Times, Wall Street Journal, Money magazine and many other publications. Davis, a clinical psychologist and gerontologist, has more than 44 years experience as a mental health provider. In addition to serving his patients, Davis creates online courses and products to assist professionals and the public with understanding aging issues. Rosenblatt and Davis have been married for 34 years.

Jun 18, 2019 | aging, aging investor, cost of aging, cost of long term care, declining health, elder investor, elderly, finances for elders, financial advisors, financial judgement, long term care, nursing home, resources for senior, resources for seniors, retirement, retirement planning, senior investor, seniors finances

An Important Question For Your Clients Contemplating Retirement

Longevity is increasing, as millions of Americans are living to 90 years and above, the U.S. Census Bureau reports. Will any of these long-lived folks be the parents of your current clients? Some clients reaching retirement age themselves will be dealing with the challenges of their aging family members, even as they plan their own retirement years.

One critical question perhaps not built into your calculations for retirement income needs should be whether your clients can reasonably expect to have to support their aging parents. As reported by NPR citing the Census Bureau report, nearly 20 percent of 90- to 94-year-olds live in nursing homes. Among those 95-99, about 31 percent are in nursing homes. And in the 100+ population, 38.2 percent live in nursing homes. Who pays for that care?

Most financial advisors have a basic understanding that Medicare benefits are very limited when it comes to nursing home care. Post hospitalization, the maximum benefit is 100 days and most people do not receive even that, due to qualification requirements. For those who have to live in nursing homes long term, rather than for shorter stays involving rehabilitation such as physical therapy, the costs are paid out of pocket. The exception is for the lowest income elders. For them, Medicaid pays the cost of long term nursing home care. For everyone else, a long stay in a nursing home can wipe out an older person’s assets. The financial burden then falls on family who may have the means to prevent the impoverishment of their loved one.

Some adult children will not allow Mom or Dad to live in a nursing home long term. Maybe it was a promise they made to the aging parent. Essentially, it is no one’s first choice of where to go when care is needed. If a family has some assets but does not want to wipe out their own retirement income by paying for nursing home care or even full-time home care, the most cost effective solution is to take in the aging parent.

There is a cost involved in this choice as well, and it extends to many factors beyond money. Every family relationship in the household is impacted. Some adult children are not patient, not willing and not good at caring for an impaired aging parent in declining health. For others it is seen as an honor and a final chance to give back to the parent in gratitude for what the parent did for them over a long lifetime. Individuals vary in their perspectives, ability and willingness to take in an aging loved one.

Some families take in an aging parent and pay for part-time help, providing a significant part of the caregiving themselves. Others pay for assisted living for an aging parent, but that is not suitable for those who need care around the clock. Others allow a parent to spend down their assets until they can qualify for state paid nursing home care. The parent is then placed there somewhat as a last resort.

No matter what choice a client will make about an aging parent, it is important that the financial professional in their lives helps them see the big picture and plan according to anticipated needs for both the client and the elders for whom they feel responsible.

The Takeaways

- Longevity is creating an issue for families who are facing years of decline in aging parents who may not have the means to pay for care on their own.

- Responsible financial advisors must raise the question with every retiring client: is there someone in your life that you will likely have to support financially during your retirement?

- Advisors and families alike must consider and plan for how any essential financial support should be handled by adult children of aging parents. Take in the parent? Supplement the parent’s income by paying for home care or assisted living?

- When the means are not available to offer financial support, and the physical needs for care are extensive, it sometimes becomes necessary to allow the aging parent to become impoverished and to qualify for Medicaid. Medicaid does pay for long term nursing home care.

- For those with sufficient investment income expected, financial support for aging parents can be part of an overall retirement planning strategy. It is up to the financial professional to help with this process.

Carolyn L. Rosenblatt, RN, Attorney, AgingInvestor.com ©AgingInvestor.com™

If you the financial professional need a clear explanation of the actual costs of long term care, whether at home, in adult day centers, assisted living or skilled nursing, get the facts so you can plan with clients. It’s all laid out for you in Hidden Truths About Retirement & Long Term Care, available now. Click here to get your print, digital, or audio copy.

About Carolyn Rosenblatt and Dr. Mikol Davis

Carolyn Rosenblatt and Dr. Mikol Davis are co-authors of The Family Guide to Aging Parents (www.agingparents.com) and Succeed With Senior Clients: A Financial Advisors Guide To Best Practices. Rosenblatt, a registered nurse and elder law attorney, has more than 45 years combined experience in her professions. She has been quoted in the New York Times, Wall Street Journal, Money magazine and many other publications. Davis, a clinical psychologist and gerontologist, has more than 44 years experience as a mental health provider. In addition to serving his patients, Davis creates online courses and products to assist professionals and the public with understanding aging issues. Rosenblatt and Davis have been married for 34 years.

May 9, 2019 | aging, aging investor, cost of aging, declining health, diminished cognition, elder investor, elderly, finances for elders, financial advisors, financial capacity, financial elder abuse, financial judgement, handling money for aging parents, handling money for seniors, resources for senior, resources for seniors, scammers, senior citizen investor, senior investor, seniors finances

The Senior Safe Act allows you to hold transactions when you suspect financial abuse of a client. The Act is designed, at least in theory, to allow time for the trusted contacts you have on file to take appropriate action. Many of those victimized by predators or manipulated by unscrupulous family have dementia and have lost their judgment about what makes sense financially. The Act urges you to get trusted contacts and provides that you are not breaking privacy rules to contact them in the reasonable belief that your client is being financially abused. The length of time you can hold a requested transaction can be as long as a month. This is where the Senior Safe Act has missed the mark.

Let’s look at the reality of impaired elders who are in charge of their wealth on the family trust. The trust is in order, and if the elder recognizes that he or she is experiencing decline in mental ability, that trustee may choose to resign. Simple. But that is not what happens in too many cases. For many persons who have cognitive decline and dementia, the elder does not recognize that he is impaired at all. “I feel fine!” he tells his worried family. When asked to resign as trustee, having total control over (theoretically) millions of dollars in a trust, the elder flatly and stubbornly refuses. Meanwhile, financial abuse by predatory people can continue unabated.

When an older person experiences cognitive decline, it typically has a very slow onset. Short-term memory loss does not raise enough red flags for those closest to the elder to take any action. “She’s just getting old” they say dismissively. But memory loss is often the first and earliest warning sign of Alzheimer’s disease, the most common form of dementia. The odds of having Alzheimer’s disease by age 85 are at least one in three. Think about your own older clients. Some live well beyond age 85. The risk of dementia rises with age. Short-term memory loss interfering with daily life is not a normal part of aging. Financial abuse and cognitive impairment often go together.

When financial abuse reaches a visible level, the advisor may do what the law allows and call the trusted contact person, usually an adult child. The advisor hopes that the call will somehow trigger something and the abuse will be stopped. But here is a reality check: The family can’t accomplish anything needed in two weeks or even a month if you hold transactions then. Here is a real case example of just such a situation, showing how long it really did take.

In our work with a family at AgingParents.com we saw rampant financial abuse of an elder by a family member. The elder had dementia but had not been formally diagnosed by his doctor. Over 70% of his income was going to the predator. He was asked to resign as trustee by his two adult children, who were reasonably worried that he was going to give away all his cash and further encumber his home. The dad, whom we’ll call Gene, had been developing dementia for at least two years. He felt obligated to the predator and was totally powerless in resisting her demands for money. He just kept writing checks, draining his own resources. It was clearly a case of financial manipulation.

We were involved in working to persuade Gene to allow what his family trust provided: to have his daughter, Jennie, become the successor trustee. He agreed, then reneged. He accepted the logic and then refused to accept it. The kids had no choice but to use the law to take over control. Their father was too stubborn to resign as trustee when asked, even with the entire family presenting a united front, asking and respectfully begging.

The trust, like many such documents provided that Gene could be removed as trustee by his appointed successor, his daughter, after two physicians had declared him to be incapacitated for handling his own finances. A court decision was not required. However, getting him to two doctors willing to assess him and put their observations in writing was a challenge that took months to accomplish. The total time spent getting the change of trustees accomplished according to the terms of Gene’s trust was eight months.

His children were the trusted contacts in the advisor’s file. They knew about the abuse and were in agreement with the advisor that Gene had to stop being the trustee. The adult children had to hire consultants (AgingParents.com), have meetings, hire an attorney, and try various methods to get the job done. Their time energy and thousands of dollars were expended to prevent an even worse outcome, which was being left to support their aging father if he were to totally deplete his own funds.

The takeaways:

- Though well intended, we do not expect that the Senior Safe Act will do much to stop financial abuse because of the short time allowed for a financial professional to hold transactions. In Gene’s case, the predator would have been happy to wait a mere two weeks or a month before resuming the financial manipulation of Gene.

- Know that any older impaired client may not understand that he or she is cognitively impaired and will ignore pleas to resign as trustee with total control over any family trust.

- If you see that an older client is showing signs of cognitive decline, do not wait until it gets worse. Reach out at the time of your first suspicions of trouble. The family or other trusted persons may well have a better opportunity to persuade an elder to transfer power over finances to the appointed successor before complete loss of capacity. Expect this to take time.

In the case described above as a result of ongoing financial abuse, nearly all of Gene’s cash was depleted during the eight months of effort on the part of his adult children to have him removed. The advisor did the right thing but too much of Gene’s cash was depleted in the period when the abuser could keep manipulating him for those months of effort by family to have him removed as trustee.

By Carolyn L. Rosenblatt, RN, Elder law attorney, AgingInvestor.com

If you are seeing abuse and feel lost about how to stop it, contact us at AgingInvestor.com for a confidential consultation with our nurse-lawyer, geriatric psychologist team so you can do everything possible to protect your vulnerable client.

Apr 25, 2019 | aging, aging investor, declining health, diminished cognition, elder investor, elderly, finances for elders, financial advisors, financial capacity, financial judgement, handling money for seniors, health, senior investor, seniors finances

Clients Without Family: Financial Planning With “Elder Orphans”

Every financial advisor will eventually come across an aging client who is essentially alone in the world. The elder may be single, widowed, or otherwise without a partner. Some are members of the LGBTQ community and never had children. Others were childless, or have lost children and significant others in their long lifetimes. The end result is that the usual support systems that exist for others are not available to these clients when they may need support the most.

Some refer to these elders who are alone with no family as “elder orphans”.

Heidi is an example. She has a financial advisor who has worked with her over decades. He referred her for advice, which she wanted and I visited her at home. She is 90 and lives alone in her own house, which she owns outright. She has a modest portfolio and is comfortable. She was widowed 20 years ago and she has no children, nor any relatives in the U.S. She relies on her best friend and neighbor when she needs help. This need is increasing now that her vision is impaired. When I spoke with Heidi I asked her about her one best friend. She mentioned that this neighbor is 86, but is “doing pretty well”. Heidi had recently fallen twice in her home, but fortunately escaped serious injury from those falls.

Heidi has a will and a trust, power of attorney and healthcare directive. The appointed person on those documents is her cousin who lives in another country. If an emergency occurs, it is not at all clear who would be available to assist her.

This situation is a disaster waiting to happen. The risk of another fall, vision problems that will likely prevent her from driving, and the age-related risks to her friend the 86 year old who could also become disabled or unavailable are all looming. I ask if her financial advisor has discussed the future with her, possible other living arrangements, a local person for a healthcare agent and what to do when she can no longer drive. “No” she replies, “we’ve never gotten into that”.

I urged Heidi to contact her financial advisor right away so plans could be made and her safety assured. She also needed to speak with her estate planning attorney to update her documents, ensuring that an appointed local person had authority to assist in any crisis or if Heidi loses independence. She is close to needing help now.

Think about your book of business and whether you have any “elder orphans” in it. If so, there are things any responsible advisor should address with such clients. Here are three essentials for every advisor’s discussion.

- First, the legal documents. The advisor can get permission from the client to contact the estate planning attorney and find out what plans exist for an appointed person to step in and take over the reins when or if the client becomes impaired. a local appointee is critical. Someone has to be able to make financial decisions if the client loses the ability to make them independently.

- Next, alternative living arrangements. A 90 year old with impaired vision who has fallen at home may need to consider options of where to live with help available onsite. The financial advisor knows what assets are available to pay for a choice such as assisted living. The advisor should bring this up and ask the client about what he or she wants.

- The need for a local appointed person to be not only the advisor’s trusted contact, but your client’s person to reach in the event of an emergency. An appointee in another country is not going to be of immediate help. Explore other choices.

The advisor needs to expand the limits of the usual role of simply managing the money with elder clients who do not have any family. To keep you on track and aware of the special planning these aging investors need, get your free checklist of points to address at AgingInvestor.com. With it, you can be sure of what you need to cover in your planning conversations with you “elder orphan” clients. Download Your Advisor’s Seven Point Checklist— Best Planning For Aging Clients With No Family now so you can excel in appropriate future planning.

Carolyn Rosenblatt, RN, Attorney, AgingInvestor.com

Feb 21, 2019 | aging, aging investor, cost of aging, cost of long term care, declining health, elderly, finances for elders, financial advisors, handling money for aging parents, handling money for seniors, health, long term care insurance, resources for senior, resources for seniors, retirement planning, senior citizen investor, senior investor, seniors finances

It used to be that we could think of retirement in a kind of predictable way. People lived into their 70s perhaps, and we measured retirement by that. We used tables, algorithms and other tools to tell us how much we should save and how much we could spend in retirement. And it was all based on assumptions that may no longer apply.

Life expectancy for a woman in the U.S. in 2018 was 84 years. For a man, the figure is 80 years. Those averages do not take into account the fact that well educated and financially secure people live longer than average. This is presumably based on the notion that people who know what a healthy lifestyle is and who can afford the best medical care will outlive those who do not have those advantages. In my own county, for example, which has a high proportion of elders compared to other counties in California, one wealthy city shows a life expectancy for men of 93 years.

Suppose that your aging client lives to be 93, having retired at age 65. That’s 28 years of retirement. What the algorithms don’t clarify is what you, the advisor needs to plan for with your client during the last decade of life, from 83-93. No formula is going to help you with the individual discriminations you need to make concerning your client’s risks for care and how to assess and plan for them. They can be a substantial cost, out of pocket, not covered by Medicare, and absolutely necessary.

The way we age is determined by two main factors: hereditary tendency and lifestyle. Our genetic makeup directs only about 30% of the equation. The other 70% is driven by the way we choose to live our lives. There are plenty of folks who think that a healthy lifestyle is just too much bother. They avoid exercise, eat whatever they feel like eating, never learn to manage stress and say they’d rather die a few years sooner than give up their habits, which their doctor advises against.

Here’s the problem with that belief. Leading an unhealthy lifestyle does not just cause you to “die sooner”. Rather, it may likely cause you to live with impairments, disabilities and a need for expensive long term care for chronic health conditions. These can go on for decades.

Take obesity, for example. Over two-thirds of Americans are overweight or obese. Obviously excess weight increases our risks for all manner of health issues, including diabetes, heart disease, high blood pressure, and strokes. When a doctor makes a diagnosis of one of these, the person doesn’t typically just die on the spot and save a lot of expense later on. No. The medical providers will keep the person going with medications, surgery in some cases, lots of diagnostic monitoring and trips to the doctors. These chronic conditions usually lead to disability late in life, particularly when more than one of them exists in the same person.

If you have aging clients, you definitely need to understand health risks in a basic way, so that you can help your clients set aside funds for the care they are likely to need in the last years of their retirement lives. All of the chronic conditions I mentioned are manageable with an effort toward a healthy lifestyle but for those who do not wish to do the work involved, you can bet on a likely need for long term care. While you can’t predict the future, you can plan for risk. It’s what you do.

My own mother in law had high blood pressure and chronic kidney disease for decades. She worked vigorously at diet, exercise, social activities and other components of a healthy lifestyle. Heredity was not on her side. She lived to be 96. During the last 3 years of her life, she needed help. She moved to a seniors’ community where help was available and eventually, she paid for private caregivers. Her cost of living at the last part of her life was $120,000 a year. If this were your client, would he or she have at the ready $360,000 to pay for care? How about if there was no pursuit of a great lifestyle? The care expense could easily be 10 years.

The takeaway here is that advising for longevity needs to include the skill of assessing fundamental health risks that create a need for out of pocket, long term care. You don’t need to be a doctor and you can’t predict everything, but you can do what is reasonable to help your client plan. Ask the right questions. Keep track of your client’s general health picture.

To learn more about what to look for and what to ask, get Hidden Truths About Retirement & Long Term Care, available at AgingInvestor.com and on Amazon.

By Carolyn L. Rosenblatt, RN, Elder law attorney, AgingInvestor.com

Feb 5, 2019 | aging, cost of aging, cost of long term care, custodial care, declining health, elderly, finances for elders, financial advisors, handling money for aging parents, handling money for seniors, health, long term care, nursing home, resources for senior, resources for seniors, retirement planning, seniors finances

The financial services industry often refers to retirement planning for the future with aging clients in terms of “housing choices”. This reflects some degree of misperception about what happens as we age. For healthy people of retirement age, there is little interest in planning for the need for care and planning for loss of independence. People usually resist talking about it. We don’t choose to lose our independence. It happens. It is up to the advisor to raise it if you want to advise for longevity. The subject is emotional and can be difficult.

Where we need to get help when we can’t be independent any longer is really a choice about care, rather than housing. This is not house shopping. Does a client want to pay for care in her own home when that time comes? Most would say yes, they want to remain at home. They then must calculate what a home care worker costs and whether that is the best way to receive the help they are likely to need one day with their activities. Can the resources be available to enable that choice of where care will be given?

If an elderly client is living alone and can’t manage at home anymore without assistance, there are indeed choices, often driven by the degree of care needed and the cost of getting it. Elders may not be interested any longer in maintaining a house, cooking, shopping, and other necessary chores. For them, assisted living may be desirable because their daily lives will be different and free from the burden of the household that has become unmanageable. The choice to go to assisted living is usually not one a client is going to make because of wanting to downsize into an apartment for its own sake. Rather that is the price of going to the place where assistance is on hand. Again it is to receive care, not because they love the idea of not having their home any longer. For many elders, downsizing from a house to an assisted living apartment is a difficult adjustment, required because of physical or mental changes of aging. From that perspective it is a choice forced upon them.

A factor every advisor should know is that the likelihood of living alone increases with age. Almost half of women age 75+ lived alone in 2010, according to the Institute on Aging. The “choice” of a different living arrangement is brought on by safety and care concerns, often raised by their adult children.

It will be good for every advisor who wants to help clients plan for longevity to consider that their role is to introduce the issue of possibly needing care in the future, as about 70% of us will one day. If your client has you in her life, she already has housing. Planning for “housing” is a misnomer. Focus on places and choices where care can be delivered. Having no care plan can be disastrous, as sudden health crises can force decisions without considering the cost of care in advance.

In helping to educate your client about where he or she can receive care, the costs of all the offerings available in most areas are spelled out in detail in our book, Hidden Truths About Retirement & Long Term Care. You can develop quick expertise on the subject there. Skilled advice about longevity for your aging clients requires knowing your numbers, what care options are available where they live and how much they can expect to spend for that care. Smart advisors gather the data before a crisis happens and urge clients to look at it with them.

By Carolyn L. Rosenblatt, RN, Elder law attorney, AgingInvestor.com

Jan 30, 2019 | aging, aging in place, cost of aging, cost of long term care, declining health, diminished cognition, elderly, finances for elders, financial advisors, financial capacity, handling money for seniors, long term care, nursing home

Most advisors who even ask this question of their retirement-aged clients never spend time on it. About 90% of those asked say they want to remain in their own homes as long as possible. That sounds fine. Until one faces physical decline, cognitive impairment or both. The advisor providing competent guidance about financing aging at home had better know the facts.

None of us like to think about losing physical ability or needing help. We abhor the thought of losing our total independence. In our view at AgingInvestor.com, the only advice clients are getting is about the long term picture is whether or not to purchase long term care insurance. Since most people don’t do that, the actual costs of living at home can boggle the mind. It’s the best advisor’s obligation to educate your client about the risks of the plan to age in place, just as it is your obligation to educate them about balancing their portfolios. You are giving the client added value if you take the time to talk them through the risks and dollars they may need to have available.

Here are some briefly stated facts from a real case in which an 89 year old wanted to age in place and his wife promised he would never have to leave home.

At the outset of his declining health, he had about $3M in invested assets. His portfolio was healthy and balanced for his age, according to conventional wisdom. He began to lose his ability to walk due to multiple medical problems. His wife hired home helpers, three days a week at first. As his conditions progressed he needed more and more help. He had to have a wheelchair, and a special van. A stair chair was installed in their two-story home. By the time he reached age 95, he was spending over $150,000 a year on care and assistance around the clock. In the space of time during which he was steadily losing independence until he passed away at 95, his assets were depleted to the tune of $2M. He lived in a higher end market for the needed help but the reality is that in any market, the kind of care he needed would be very expensive.

For him, aging in place was more costly than a skilled nursing facility would have been. Home modifications, private caregivers, (none of whom were licensed nurses), equipment, medications, adaptive devices, etc. drained his resources by 2/3. And not everyone has as much invested as he had to even start the journey. His wife had her own assets and she paid the cost of household maintenance, taxes, food, and utilities with her funds. Had she relied on him for those things too, there would likely have been little left at the end of his life.

It is not all doom and gloom however. Many clients live rather well in their last years without all the care this gentleman needed. Some get by with family caregiving help, and some have fewer medical conditions. But if you are going to competently help your clients plan for longevity, it’s essential to understand the real out of pocket costs of aging in place or anywhere else outside the home. If you want to add value to your services to older clients, know what they need to know to properly anticipate what can happen with living into one’s 90s and beyond.

Learn all the actual costs of care for every aging client option in our book, Hidden Truths About Retirement & Long Term Care. Be well prepared to walk your client through the scenarios they could face in their futures. You distinguish yourself from other advisors when you sharpen your knowledge in planning for longevity.

By Carolyn Rosenblatt, RN, Attorney, AgingInvestor.com

Jan 28, 2019 | aging, aging in place, aging investor, cost of aging, cost of long term care, custodial care, declining health, diminished cognition, elder investor, elderly, finances for elders, financial advisors, financial capacity, financial elder abuse, financial judgement, handling money for seniors, health, long term care, nursing home, resources for seniors, seniors finances

Your clients are getting ready for retirement. You’ve done the calculations, balanced the portfolio and advised them of what income to expect. You’ve discussed how much spending is ok. You used your program and your analysis was thorough. You’ve done your job, right?

Not exactly. There is probably no algorithm nor program that will calculate your client’s individual profile of health risks that will likely lead to the expense of long term care. That can be a whopper. Maybe you’ve suggested long term care insurance. Most people don’t choose to buy it. For those who do, the benefits are limited and the “elimination period” (deductible) is thousands of dollars. There go your careful calculations. At least 90% of folks don’t have that coverage. Now what?

But how can you predict what’s going to happen to anyone’s health in retirement, you ask. You can’t be precise, but you surely can make some rational observations and give advice accordingly. Those observations consist of two parts: what you can see with your own eyes and what you can glean by asking a few basic questions. If you think asking any client about their health conditions is too nosy or not your job, consider that if the client needs long term care and runs out of money because of it, they’re not going to think much of you. And the cost can wipe out their security.

Asking about health issues is not nosy at all. Rather, it’s what any smart advisor planning for longevity must do. Let’s not keep pretending that everyone stays the same physically and mentally from the start of retirement to end of life. Our bodies go through wear and tear and things break down. Cognitive decline affects at least a third of people who reach the age of 85. The risk of Alzheimer’s disease keeps climbing after that. Now, what was that life expectancy you were using in your calculation? Was it age 99?

Let’s start with what you can see in your client with your own eyes. (If they’re not in front of you, perhaps Skype is an option). Is your client obese, as about 40% of the U.S. population is? This leads to heart disease, stroke, and diabetes, among other diseases and conditions. The medical care people receive in many cases will save them from dying but they then live with disabilities. And yes, they will be very likely to need expensive long term care. Neither health insurance nor Medicare will cover long term care. Such help as a part time caregiver at home is how most folks start out with long term care. Your client pays out of pocket most of the time. Did you calculate how much it costs as well as how long they will likely need it? If they have multiple medical conditions, and have started long term care, they’ll probably continue to need some form of it for all their remaining years.

Find out what you may not know from simply observing your client’s appearance by asking questions. You can make your own list or get a health care provider to help you with a few targeted questions. You will need to educate your client as to the reason why you need this information. It’s to help them plan for how much to save in their retirement years.

Here are some examples of basic questions that can help you predict the need for possible long term care:

- How’s your health these days? Has a doctor told you that you have any long term conditions?

- Are you taking medications? What are they for?

- Do you smoke?

- Are you concerned at all about any health issues you have at this time?

Do you recall your parents’ ages when they died?Your aging clients will not be eager to talk about the potential need for long term care. When you told them about what to expect for “out of pocket medical costs in retirement”, you did not give them a figure that included long term care. Long term care is not “medical” according to Medicare. Rather, it is called “custodial care”. The client probably will not bring it up, so you must do this.

When you have done your observations and gotten answers to your health-risk related questions at least there is a place to start a meaningful conversation. You can give them figures as to the cost of typical kinds of care, such as a non-medical home care worker. We at AgingInvestor.com recommend starting your projections at age 80 as to when a person might need physical help. Many of us know someone who did require help with at least some part of his or her life at that age. Then you can talk about how any condition your client identifies for you, such as high blood pressure, diabetes, etc. as shortening normal life expectancy and increasing the risk for needing help. If your client already has difficulty with some normal daily activity such as walking or bathing, they are definitely at high risk for needing paid help sooner than a person without these problems.

Clients may be completely unaware of such things as the hourly cost of a home care worker, what assisted living costs each month and what home modifications cost if they are able to remain in their own home. You can find a thorough discussion of these and many other parts of long term care in our book, Hidden Truths About Retirement & Long Term Care, written specifically for financial advisors like you.

Every conscientious advisor needs to wake up to the reality that your retirement income calculator omits the reality check of health problems. We’re not talking about nursing homes, but every other kind of care and help most people will need as they age. If you do want to help clients who are reaching retirement age to plan realistically, include the health risks you can see or learn about by asking.

By Carolyn L. Rosenblatt, RN, Elder law attorney, AgingInvestor.com

Jan 24, 2019 | aging, aging in place, declining health, diminished cognition, elderly, financial advisors, health, long term care, resources for seniors

Jan 18, 2019 | aging, aging in place, aging investor, cost of aging, declining health, elderly, finances for elders, financial advisors, handling money for aging parents, handling money for seniors, health, long term care, resources for seniors, retirement planning, seniors finances

Most advisors who even ask this question of their

retirement-aged clients never spend time on it. About 90% of those asked say

they want to remain in their own homes as long as possible. That sounds fine. Until one faces physical

decline, cognitive impairment or both. The advisor providing competent guidance

about financing aging at home had better know the facts.

None of us like to think about losing physical ability or needing help. We abhor the thought of losing our total independence. In our view at AgingInvestor.com, the only advice clients are getting is about the long term picture is whether or not to purchase long term care insurance. Since most people don’t do that, the actual costs of living at home can boggle the mind. It’s the best advisor’s obligation to educate your client about the risks of the plan to age in place, just as it is your obligation to educate them about balancing their portfolios. You are giving the client added value if you take the time to talk them through the risks and dollars they may need to have available.

Here are some briefly stated facts from a real case in which

an 89 year old wanted to age in place and his wife promised he would never have

to leave home.

At the outset of his declining health, he had about $3M in

invested assets. His portfolio was healthy and balanced for his age, according

to conventional wisdom. He began to lose his ability to walk due to multiple

medical problems. His wife hired home helpers, three days a week at first. As

his conditions progressed he needed more and more help. He had to have a wheelchair, and a special

van. A stair chair was installed in their two-story home. By the time he

reached age 95, he was spending over $150,000 a year on care and assistance

around the clock. In the space of time during which he was steadily losing

independence until he passed away at 95, his assets were depleted to the tune

of $2M. He lived in a higher end market for the needed help but the reality is

that in any market, the kind of care he needed would be very expensive.

For him, aging in place was more costly than a skilled

nursing facility would have been. Home modifications, private caregivers, (none

of whom were licensed nurses), equipment, medications, adaptive devices, etc.

drained his resources by 2/3. And not everyone has as much invested as he had

to even start the journey. His wife had her own assets and she paid the cost of

household maintenance, taxes, food, and utilities with her funds. Had she

relied on him for those things too, there would likely have been little left at

the end of his life.

It is not all doom and gloom however. Many clients live rather well in their last years without all the care this gentleman needed. Some get by with family caregiving help, and some have fewer medical conditions. But if you are going to competently help your clients plan for longevity, it’s essential to understand the real out of pocket costs of aging in place or anywhere else outside the home. If you want to add value to your services to older clients, know what they need to know to properly anticipate what can happen with living into one’s 90s and beyond. Learn all the actual costs of care for every aging client option in our book, Hidden Truths About Retirement & Long Term Care. Be well prepared to walk your client through the scenarios they could face in their futures. You distinguish yourself from other advisors when you sharpen your knowledge in planning for longevity.

By Carolyn Rosenblatt, RN, Attorney, AgingInvestor.com

Nov 15, 2018 | aging, aging investor, cost of aging, cost of long term care, custodial care, declining health, elder investor, elderly, finances for elders, financial advisors, financial capacity, financial judgement, handling money for aging parents, handling money for seniors, health, investor, long term care, seniors finances

Your clients are getting ready for retirement. You’ve done the calculations, balanced the portfolio and advised them of what income to expect. You’ve discussed how much spending is ok. You used your program and your analysis was thorough. You’ve done your job, right?

Not exactly. There is probably no algorithm nor program that will calculate your client’s individual profile of health risks that will likely lead to the expense of long term care. That can be a whopper. Maybe you’ve suggested long term care insurance. Most people don’t choose to buy it. For those who do, the benefits are limited and the “elimination period” (deductible) is thousands of dollars. There go your careful calculations. At least 90% of folks don’t have that coverage. Now what?

But how can you predict what’s going to happen to anyone’s health in retirement, you ask. You can’t be precise, but you surely can make some rational observations and give advice accordingly. Those observations consist of two parts: what you can see with your own eyes and what you can glean by asking a few basic questions. If you think asking any client about their health conditions is too nosy or not your job, consider that if the client needs long term care and runs out of money because of it, they’re not going to think much of you. And the cost can wipe out their security.

Asking about health issues is not nosy at all. Rather, it’s what any smart advisor planning for longevity must do. Let’s not keep pretending that everyone stays the same physically and mentally from the start of retirement to end of life. Our bodies go through wear and tear and things break down. Cognitive decline affects at least a third of people who reach the age of 85. The risk of Alzheimer’s disease keeps climbing after that. Now, what was that life expectancy you were using in your calculation? Was it age 99?

Let’s start with what you can see in your client with your own eyes. (If they’re not in front of you, perhaps Skype is an option). Is your client obese, as about 40% of the U.S. population is? This leads to heart disease, stroke, and diabetes, among other diseases and conditions. The medical care people receive in many cases will save them from dying but they then live with disabilities. And yes, they will be very likely to need expensive long term care. Neither health insurance nor Medicare will cover long term care. Such help as a part time caregiver at home is how most folks start out with long term care. Your client pays out of pocket most of the time. Did you calculate how much it costs as well as how long they will likely need it? If they have multiple medical conditions, and have started long term care, they’ll probably continue to need some form of it for all their remaining years.

Find out what you may not know from simply observing your client’s appearance by asking questions. You can make your own list or get a health care provider to help you with a few targeted questions. You will need to educate your client as to the reason why you need this information. It’s to help them plan for how much to save in their retirement years.

Here are some examples of basic questions that can help you predict the need for possible long term care:

- How’s your health these days? Has a doctor told you that you have any long term conditions?

- Are you taking medications? What are they for?

- Do you smoke?

- Are you concerned at all about any health issues you have at this time?

- Do you recall your parents’ ages when they died?

Your aging clients will not be eager to talk about the potential need for long term care. When you told them about what to expect for “out of pocket medical costs in retirement”, you did not give them a figure that included long term care. Long term care is not “medical” according to Medicare. Rather, it is called “custodial care”. The client probably will not bring it up, so you must do this.

When you have done your observations and gotten answers to your health-risk related questions at least there is a place to start a meaningful conversation. You can give them figures as to the cost of typical kinds of care, such as a non-medical home care worker. We at AgingInvestor.com recommend starting your projections at age 80 as to when a person might need physical help. Many of us know someone who did require help with at least some part of his or her life at that age. Then you can talk about how any condition your client identifies for you, such as high blood pressure, diabetes, etc. as shortening normal life expectancy and increasing the risk for needing help. If your client already has difficulty with some normal daily activity such as walking or bathing, they are definitely at high risk for needing paid help sooner than a person without these problems.

Clients may be completely unaware of such things as the hourly cost of a home care worker, what assisted living costs each month and what home modifications cost if they are able to remain in their own home. You can find a thorough discussion of these and many other parts of long term care in our book, Hidden Truths About Retirement & Long Term Care, written specifically for financial advisors like you.

Every conscientious advisor needs to wake up to the reality that your retirement income calculator omits the reality check of health problems. We’re not talking about nursing homes, but every other kind of care and help most people will need as they age. If you do want to help clients who are reaching retirement age to plan realistically, include the health risks you can see or learn about by asking.

By Carolyn L. Rosenblatt, RN, Elder law attorney, AgingInvestor.com

Feb 2, 2018 | aging, aging investor, declining health, diminished cognition, elder investor, elderly, finances for elders, financial advisors, financial capacity, financial elder abuse, financial judgement, scammers, seniors finances

You may have heard of the fake calls from thieves pretending to be from the IRS. It can be a threatening robocall. Or it can be a male with an aggressive manner telling the recipient of the call that they will be arrested for owing back taxes if they don’t pay immediately. These criminals carefully select older people and anyone they consider vulnerable to their fake pressure. Your aging clients could be a target and scammers want to terrify them.

How do they get the names of our aging parents? They buy them. Information is for sale, from lottery entry forms, contests, magazine subscriptions and from hacking whatever can be hacked. Identity information can even be purchased on the black market. “Information brokers” have been around for decades and so have these telephone scams. Supposedly, the entities that sell the names don’t care what the buyer does with them. There are likely millions of names and telephone numbers available to the scammers, given the nationwide nature of their ripoff efforts. Apparently, names and numbers are very easy for them to get.

Here’s how it works: The caller catches the unsuspecting older person off guard. The call is official sounding: “This is Officer James with the Internal Revenue Service and I am calling about an urgent matter! Do not hang up!” Sometimes they are even able to secure a fake caller ID that says “IRS” or looks like a legitimate government entity to those with caller ID. There were also reported cases when they used the name and email address of a CFPB employee.

They then tell the stunned elder that they or their spouse has an overdue debt to the IRS and if it is not paid immediately they will be arrested. Of course, they want the elder to use a wire transfer or a prepaid debit card so the thief can’t be traced. The frightened person will hurriedly comply and realize only later that it was a scam. In the moment of reacting to the threat, they are not thinking clearly. They are moved by fear–just what the thief was hoping for.

No matter how many public service announcements are sent out, and no matter how many Federal Trade Commission, AARP or National Center on Elder Abuse warnings are posted, the scam is still working. We at AgingParents.com think the best way to keep our aging loved ones financially safer is to personally warn them yourself about these scams. They will probably listen to family more readily than they would seek information from the internet or official sources trying to spread the word. Of course, the IRS will never, under any circumstances call someone and demand payment of a debt. Their official communications about taxes are by snail mail.

If these evil scammers were not successful, they would stop doing this. But sadly, it works and they are relentless. My neighbors, many elders, have reported that they have gotten these calls this week. Beware. Please take the time to alert your loved ones to this problem. And don’t think your mentally alert aging loved one is too smart to fall for this. No one is immune from being shocked and intimidated by a sudden call. It can happen to anyone.

We at AgingInvestor.com think the best way to keep your older clients financially safer is to personally warn them yourself about these scams. They will probably listen to family more readily than they would seek information from the internet or official sources trying to spread the word. Of course, the IRS would never, under any circumstances call someone and demand payment of a debt. Their official communications about taxes are by snail mail and that is not likely to change anytime soon.

If these evil scammers were not successful, they would stop doing this. But sadly, it works and they are relentless. My own neighbors, many elders, have reported that they have gotten these calls this week. Beware. Please take the time to alert your clients to this problem. And don’t think your ever so sharp client is too smart to fall for this. No one is immune from being shocked and intimidated by a sudden call. It can happen to anyone.

If you want to send a friendly letter to your clients about this scam and don’t have time to put it together, we make it easy for you. Just go to this link and download a free pre-made letter to send out.

Revise it with your name or firm name and you’ll look good by showing that you do care about their financial safety. You’ll never regret doing your part to thwart thieves and prevent financial elder abuse.

Revise it with your name or firm name and you’ll look good by showing that you do care about their financial safety. You’ll never regret doing your part to thwart thieves and prevent financial elder abuse.

|

|

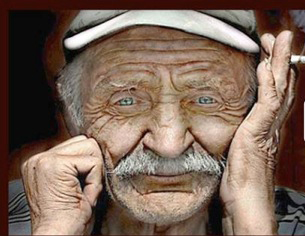

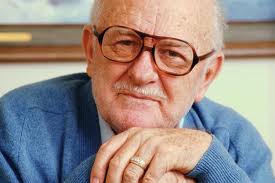

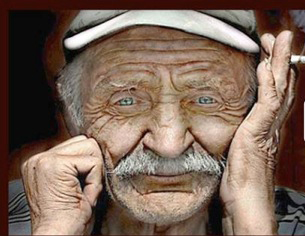

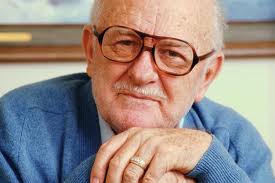

Dr. Mikol Davis and Carolyn Rosenblatt, co-founders of AgingInvestor.com

Carolyn Rosenblatt, RN, Elder Law Attorney offers a wealth of experience with aging to help you create tools so you can skillfully manage your aging clients. You will understand your rights and theirs so you can stay safe and keep them safe too.

Dr. Mikol Davis, Psychologist, Gerontologist offers in depth of knowledge about diminished financial capacity in older adults to help you strategize best practices so you can protect your vulnerable aging clients.

They are the authors of "Succeed With Senior Clients: A Financial Advisors Guide To Best Practice," and "Hidden Truths About Retirement And Long Term Care," available at AgingInvestor.com offers accredited cutting edge on-line continuing education courses for financial professionals wanting to expand their expertise in best practices for their aging clients. To learn more about our courses click HERE

|

May 8, 2017 | aging, aging investor, declining health, elder investor, elderly, finances for elders, financial advisors, financial capacity, financial elder abuse, financial judgement, handling money for aging parents, senior citizen investor, senior investor, seniors finances

Your older investors are sure it will never happen to them but Medicare fraud can trick anyone. Even those without a hint of cognitive decline can get taken by scammers. At AgingInvestor.com, we educate advisors about protecting clients from elder financial abuse and we thought we had our own family covered. With a 94 year old mother, we are especially alert. We were stunned when mom told us that someone “from Medicare” had called and asked her to “verify” her personal information.

Alice is a sharp 94 year old, living mostly independently in a seniors’ complex. She’s active, does her own shopping and is engaged with her neighbors in the community. She had an issue with Medicare not paying a bill for a service she had received some months prior. With our help, she had undertaken an appeal process, which involves a lot of repetitive paperwork. When a man saying he was from Medicare called, she thought it was about the appeal. Of course it wasn’t. The scammer asked her to “verify” her Social Security number, her address, date of birth and mother’s maiden name and she gave him that information.

A few hours later, she mentioned what had happened and said she had been wondering if it was right to give out that information. We were shocked! How is it that she didn’t see the potential ID thief when we talk about this all the time? We knew we had to jump on this right away to stop the thieves from using the information to open new accounts in her name. Hours were spent the next day calling the two banks where she had accounts, her credit card company, the credit reporting agencies and Social Security. We had to stop the auto debits on her bill payments. We cleaned up the mess.

So far so good. No unauthorized transactions have happened. Her old accounts were closed and new ones opened. Social Security sends her payments to the new account. Fraud alerts are on everything now. Whew! This was a lesson that even the alert older person can get fooled with the right pitch on the phone.

Here’s the takeaway.

Warn your clients: Medicare will NEVER call and ask you for your personal information. Never give it out unless you place a call to order something that you know is legitimate.

Medicare fraud can happen in many forms. This was just one of them. I believe that there was probably a connection between her Medicare appeal and the fraud attempt. It’s too much of a coincidence that they called when she had communication with Medicare going on already with her appeal. The appeal had not yet been resolved. This information got into the wrong hands, making it easy to trick a sharp person by saying he was calling from Medicare. Mom could be just like any one of your older clients.

Why is this important? You’re on the front lines and you have a trusting relationship with clients. Speak up and make basic efforts to educate them about these scams. A lot of money can be drained from an account instantly with all the client’s personal information out there. Make yourself look good. A word from you can remind your aging clients that you care about their financial safety and that you are looking out for them.

Learn more about protecting aging clients from financial abuse in Succeed With Senior Clients: A Financial Advisor’s Guide to Best Practices. Click here to purchase it now. You’ll build your knowledge about aging investors fast.

Carolyn Rosenblatt, RN, Elder Law Attorney, & Dr. Mikol Davis, Psychologist, Gerontologist, co-founders AgingInvestor.com

|

|

Dr. Mikol Davis and Carolyn Rosenblatt, co-founders of AgingInvestor.com

Carolyn Rosenblatt, RN, Elder Law Attorney offers a wealth of experience with aging to help you create tools so you can skillfully manage your aging clients. You will understand your rights and theirs so you can stay safe and keep them safe too.

Dr. Mikol Davis, Psychologist, Gerontologist offers in depth of knowledge about diminished financial capacity in older adults to help you strategize best practices so you can protect your vulnerable aging clients.

They are the authors of "Succeed With Senior Clients: A Financial Advisors Guide To Best Practice," and "Hidden Truths About Retirement And Long Term Care," available at AgingInvestor.com offers accredited cutting edge on-line continuing education courses for financial professionals wanting to expand their expertise in best practices for their aging clients. To learn more about our courses click HERE

|

Apr 17, 2017 | aging, declining health, elderly, financial capacity, financial judgement, handling money for aging parents, health, resources for senior, resources for seniors, Uncategorized

What To Do When Your Aging Client’s Health Is Failing

Financial professionals can find themselves in an uncomfortable position when they have a long time aging client who is in declining health. Of course, you know the client and can see that she’s struggling with a lot of issues. You may want to do something but this stuff is just not in your wheelhouse. Longevity is great but not when you start to lose the ability to manage on your own. What are you supposed to do for these clients?

You’re trained to understand economics, taxes, financial products, planning. But you’re not trained to direct aging people to whatever resources they may need as they get older. If they have family, you may expect family to step up, but you see that it may not be happening. Should you call them? Do you even know them? Do you have your client’s permission? And what if they don’t have family? That’s even worse. Here they are getting frail and more vulnerable by the day and you are just watching helplessly.

It doesn’t have to be that way. You can get acquainted with some basic resources in your area and the areas where your clients live. Maybe they never figured they’d live so long as to actually need help. When they do, you can be a starting point to help them find what’s out there.

Let’s imagine you have an aging client who is having trouble getting around and she needs some help with chores at home. She tells you about it when you ask her how things are going. She is shy to ask for help and reluctant to admit that it’s harder and harder to live alone. You don’t know what to say. Or do you?

One source of help everyone should know about is the Area Agency on Aging. These Federally funded programs connect elders to appropriate community organizations and places to get assistance. Their mission is to help older adults and people with disabilities live with dignity and choices in their homes and communities for as long as possible.

AAAs contract with local service providers to deliver many direct services, such as meals, transportation and in-home services. However, most agencies are direct providers of Information and Referral/Assistance, case management, benefits/health insurance counseling and family caregiver support programs.

Some are incorporated into a county’s health and human services departments. Some are separate. Large states have many AAAs. Smaller less populated states have fewer of them.

One thing you can do now to be ready to assist your own client who may demonstrate a need is to research where the nearest Area Agency on Aging is in your client’s community, download a brochure or information package and let your client know it’s there. If he needs help at home, transportation services, vetted information about local service providers, an AAA is a great place to start.

This whole aging client issue can be a reflection of things you have experienced in your own family. Perhaps you have an aging parent or ill grandparent. Another problem solving source of information is our book the Family Guide to Aging Parents: Answers to Your Legal, Healthcare and Financial Questions

. Learn what’s in it here. It can get you more comfortable with those difficult conversations.

Carolyn Rosenblatt, RN, Elder law attorney

AgingInvestor.com and AgingParents.com

Apr 11, 2017 | aging, aging investor, declining health, diminished cognition, elder investor, elderly, finances for elders, financial advisors, financial capacity, financial elder abuse, financial judgement, handling money for aging parents, handling money for seniors, senior citizen investor, senior investor, seniors finances

In a recent issue of Investment News, a study of financial advisors looked at this question. 591 advisors were asked about their experiences with elder financial abuse. One of the surprising findings focused on those advisors who knew or suspected abuse but did not report it.

A significant percentage of those who did not report abuse gave as a reason that they did not know who to contact. What is most troubling about this finding is that not knowing who to contact is such a simple problem to solve. Historically your regulators have never required that you have the name of a trusted contact for your client in order to open a file for that person. Here at AgingInvestor.com and AgingParents.com, where elder financial abuse comes up often, we think it is extremely short-sighted to be without a trusted contact or two in every client’s file. Isn’t it obvious that you need someone to call if a client gets into danger, whether it’s elder abuse or not? No one gets out of here alive and a client can live for quite a long time, developing cognitive impairment along the way. That puts a person at much higher risk for financial abuse.

New FINRA rules will require that you make “reasonable efforts” to get a trusted contact from your clients. We assure you, reasonable efforts are a lot easier to make when your client is signing up than they are when your client is 92 and forgetful or suspicious of everyone’s motives.

From us, two professionals who have worked with countless elders and their families over the last 10 years, we have three tips for every financial professional handling a client’s finances:

- You can’t ensure that your client will be competent for financial decisions forever. Be realistic! People are living longer and they may develop dementia or other cognitive impairment. Get at least two trusted contacts in every file for every client age 65 or older. Why two or more? One trusted contact might end up being the very person who is abusing your client–a family member.

- Get smart about the basics of recognizing red flags of diminished capacity. We offer a simple free checklist to help you. Click on the green button here to get yours now. These signs are warnings that your client is more vulnerable to manipulation by others.

- Know how to report financial elder abuse. You don’t have to be certain that abuse has occurred. You do need to know who may be doing it, when and how, in general (e.g., pushing your client into large, unexplained withdrawals). A reasonable suspicion is enough. It’s ok if you’re wrong. And you can do it anonymously. Call Adult Protective Services in the county where your client lives if you think someone is ripping off your vulnerable client.

Some advisors are worried that they’ll get sued for reporting suspected financial abuse. This is incorrect. Your regulators want you to report it. If you do what is reasonable, you are not a target. However, if you know that your impaired client is being financially abused and you do absolutely nothing, liability for failure to act is certainly possible.

by Carolyn Rosenblatt, RN, Elder Law Attorney, & Dr. Mikol Davis, Gerontologist, co-founders of AgingInvestor.com

|

|

Dr. Mikol Davis and Carolyn Rosenblatt, co-founders of AgingInvestor.com

Carolyn Rosenblatt, RN, Elder Law Attorney offers a wealth of experience with aging to help you create tools so you can skillfully manage your aging clients. You will understand your rights and theirs so you can stay safe and keep them safe too.

Dr. Mikol Davis, Psychologist, Gerontologist offers in depth of knowledge about diminished financial capacity in older adults to help you strategize best practices so you can protect your vulnerable aging clients.

They are the authors of "Succeed With Senior Clients: A Financial Advisors Guide To Best Practice," and "Hidden Truths About Retirement And Long Term Care," available at AgingInvestor.com offers accredited cutting edge on-line continuing education courses for financial professionals wanting to expand their expertise in best practices for their aging clients. To learn more about our courses click HERE

|

Feb 3, 2017 | aging investor, declining health, elder investor, financial advisors

Every advisor understands that you are theoretically required to know your client. But does one or two contacts a year after you do retirement planning suffice? When it comes to aging clients we at AgingInvestor.com think it takes a lot more than that. Here’s a real case that illustrates the problem with an advisor not really meeting this obligation.

Nigel is 80 and his wife, Berta is 84. Each had a large estate of separate property when they got married. Nigel owned a home in an expensive county and Berta had her own inheritance. They had had the same financial firm in a different state from where they now live for decades.

We got involved at the point of a desperate call from Nigel. His wife was being discharged from the rehab facility, he was told and he wasn’t sure what to do. He had the means to pay for private care and that was what he wanted. I consulted with him at some length and asked about the medical records. He obtained them at my request. The news was not good. His wife was terminally ill and plans for how to manage her had not been discussed with anyone: not the doctors, not the rehab folks, no one.

A person’s choices about care are driven largely by how much they have in assets that can be spent on care. I asked. He contacted his financial advisor and we all spoke together. There was plenty to cover the need, but at that point I learned that Nigel and Berta had never done any estate planning. No will, no trust, no beneficiary designation on any account naming the other as a recipient when one passed.

Where was the financial advisor in all this? Ignorant. Not involved in encouraging her clients to do what would benefit both of them. She apparently did not keep in touch with them, despite that Berta had been ill for over a year. She did not know that Berta was gravely ill and going into hospice care (comfort measures only for the terminally ill). She did not know that they were about to incur a daily cost for a private room in a well appointed nursing facility at a cost of $430 a day.

Scrambling to find an estate-planning attorney and get advice, we did accomplish what the advisor could have urged her clients to do long before this crisis. Nigel does not use a computer. The advisor emailed the power of attorney and beneficiary designation form to me and I ensured that it was signed and sent back. Now Nigel is on his wife’s account, and can access her funds, should she lose consciousness. Why, I asked did this long time advisor not do this much earlier in the planning process? At least Nigel, who needs a trust for his estate, will now have one done, no thanks to any advice from his long time advisor.

Adding value for your clients takes more than the latest algorithm and getting the best returns. It takes knowing them, their life situations, the risks posed by aging and the skill to look at the anticipated expenses of care as clients near the end of the road. The nursing home cost for what Berta needs now is not covered by Medicare.

The simplest takeaway from this: contact your clients every six months if they are at retirement age. Keep in communication and know them, not just their assets. It’s the least you can do.

Learn about the actual cost of care and how to help your clients with long term care planning in Succeed With Senior Clients: A Financial Advisor’s Guide to Best Practices. Click here to download your copy today.

Carolyn Rosenblatt, R.N., Elder Law Attorney & Dr. Mikol Davis

co-founders of AgingInvestor.com and AgingParents.com

Jan 27, 2017 | aging, aging investor, declining health, diminished cognition, elder investor, elderly, finances for elders, financial advisors, financial capacity, financial elder abuse, financial judgement, handling money for aging parents, handling money for seniors, long term care, long term care insurance, medicare, senior investor, seniors finances

Do you have older clients who seem to be doing really well physically? Some of our aging folks are remarkably sharp and we can all be lulled into a false sense of security with them. This is a heads up warning about a real situation that you can perhaps help clients avoid by a simple step. Bear in mind that your older clients may be alert but still have trouble keeping track of the occasional bill. That can lead to a true financial disaster. Here’s what happened to one person we met at AgingInvestor.com who could well be your client.

Ruth is 88, still quite independent, taking care of herself at home. She does her own shopping and cooking, drives and pays her own bills. Great at her age, right? But when it comes to memory, that’s a problem from time to time. And forgetfulness plus an unforeseen glitch caused a financial nightmare for her. Here is what happened.

Ruth has Medicare and supplemental insurance. That extra 20% the supplement pays doesn’t sound like a lot, unless you have a crisis and have to go to the hospital.